How to Get an FHA Loan in Clarksville, TN: A Comprehensive Guide

Buying a home is a big step, and if you’re eyeing the charming city of Clarksville, TN, you’re in for a treat. This guide will walk you through the process of getting an FHA loan, a popular choice for many first-time homebuyers due to its flexible requirements and lower down payment options. Let’s dive into everything you need to know to secure your dream home in Clarksville.

What is an FHA Loan?

Federal Housing Administration (FHA) Loan Basics

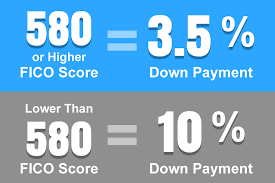

An FHA loan is a mortgage insured by the Federal Housing Administration (FHA). It’s designed to help individuals who may not qualify for conventional loans due to lower credit scores or limited savings for a down payment. With an FHA loan, you can buy a home with as little as 3.5% down, making it an attractive option for first-time buyers and those with less-than-perfect credit.

Why Choose an FHA Loan in Clarksville, TN?

Benefits of FHA Loans for Clarksville Residents

Clarksville, TN, is a vibrant city known for its rich history, beautiful parks, and thriving community. Choosing an FHA loan for your home purchase here offers several advantages:

- Lower Down Payment Requirements: With just 3.5% down, you can become a homeowner sooner.

- Flexible Credit Requirements: FHA loans are accessible to buyers with credit scores as low as 580.

- Competitive Interest Rates: Enjoy lower interest rates compared to some conventional loans.

- Assumable Loans: FHA loans can be transferred to new buyers, which can be a selling point if you decide to move.

Steps to Getting an FHA Loan in Clarksville

1. Check Your Credit Score

Before applying for an FHA loan, check your credit score. While FHA loans are more forgiving of lower credit scores, having a score above 580 will give you the best chance of approval and better terms.

2. Save for a Down Payment

Start saving for your down payment. Even though FHA loans require just 3.5%, having a bit more saved can cover closing costs and other expenses.

3. Get Pre-Approved

Find a lender experienced with FHA loans and get pre-approved. This step will give you a clear idea of how much you can borrow and show sellers that you’re a serious buyer.

4. Find a Real Estate Agent

Work with a local real estate agent who knows the Clarksville market. They can help you find homes that meet FHA requirements and fit your budget.

5. Shop for Your Home

Start house hunting! Look for properties that meet FHA guidelines, which include standards for property condition and appraisal requirements.

6. Make an Offer

Once you find the perfect home, make an offer. Your real estate agent will help you negotiate the best deal.

7. Complete the Loan Application

With an accepted offer, complete your FHA loan application. Your lender will require documentation such as proof of income, employment history, and financial statements.

8. Home Inspection and Appraisal

An FHA-approved appraiser will assess the property’s value and condition. Additionally, a home inspection is crucial to identify any potential issues.

9. Underwriting and Closing

During underwriting, your lender will review all documentation to ensure everything is in order. Once approved, you’ll close on your loan, sign the necessary paperwork, and get the keys to your new home.

Tips for a Smooth FHA Loan Process

1. Gather Documentation Early

Having all necessary documents ready can speed up the process. This includes tax returns, pay stubs, bank statements, and proof of employment.

2. Maintain Stable Employment and Credit

Avoid making large purchases or changing jobs during the loan process, as stability is key for approval.

3. Be Prepared for Closing Costs

In addition to your down payment, you’ll need to cover closing costs, which typically range from 2% to 5% of the loan amount.

Common Questions About FHA Loans

Can I get an FHA loan with a low credit score?

Yes, FHA loans are designed to help buyers with lower credit scores. Scores as low as 580 can qualify for the 3.5% down payment option.

Are there income limits for FHA loans?

No, there are no income limits for FHA loans. However, your debt-to-income ratio will be considered to ensure you can afford the mortgage payments.

Can I use an FHA loan for a fixer-upper?

Yes, the FHA 203(k) loan allows you to finance the purchase and renovation of a home with a single mortgage.

Securing an FHA loan in Clarksville, TN, can be a straightforward process with the right preparation and knowledge. By understanding the steps and requirements, you can confidently navigate the home buying journey and soon enjoy all that Clarksville has to offer. Happy house hunting!